一起开启您的传奇吧。

Secondary Wine Market

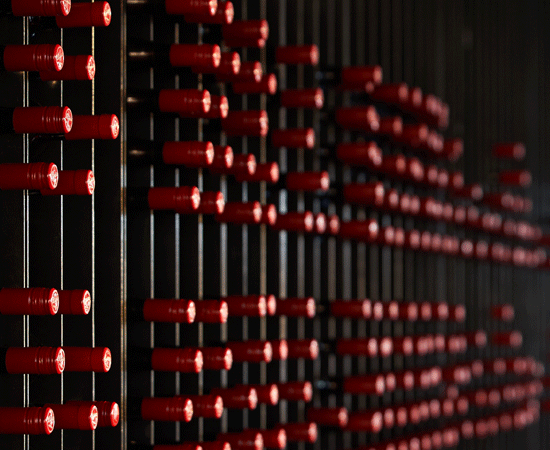

Penfolds wines have achieved great success in many important wine markets around the world. One of the most prestigious is Grange. This wine is now recognised as one of the most consistent of the world’s great wines and has won an outstanding reputation amongst global wine collectors.

What is fine wine?

To understand wine investment, first, we must understand fine wine. And, whilst defining ‘fine wine’ may be cause for debate, it’s generally accepted that quality, provenance, age-worthiness, reputation, and scarcity all play their part. Moreover, fine wine is in the eye of the beholder, that of individual perception and the secondary wine market.

The wine market

It’s important to understand that the wine industry has two markets; the primary and secondary markets. The primary market is where wine is sold directly to the consumer, and the secondary wine market is where the original owner sells their wine to make a return on their investment. Wine can be an incredible asset if you have the know-how. Limited release numbers, increased demand and rarity drive the value of wine.

It’s all about supply and demand

Investing in wine can be lucrative; we sought insight from Orazio Baldino, Penfolds Luxury Sales Manager. Over 26 years in the wine industry, Ori has explored some of Australia’s most revered private cellars.

“Ultimately, there are two types of investors. The collector who invests in happiness: this buyer tends to cellar wines they enjoy drinking. When wine comes of age, they get great pleasure sharing them, and if they aren’t enjoying the wine’s drinkability at that time (tastes change), they sell them, at the very least, getting their money back and making a small profit. These investors are often unaware of the market value of what’s in their cellar

The second is the investor who invests for monetary gain: this buyer cellars wines of provenance that have a proven return record. These investors know the value of their wine and are discerning when to buy and sell.”

A parting comment from Ori...

"I always say it's amiss if you haven't got your children’s or partners’ birth years or years of marriage, the years of significance that are special to you. For me, it’s about passing on to the next generation. I want to share those special wines with my children as they move into adulthood, for them to inherit my cellar and hopefully enjoy it. And if they don't enjoy wine or are not into it, they can sell and enjoy the monetary value."

- Orazio Baldino, Penfolds Luxury Sales Manager

Caring for your wine

One investment tip to take away is the importance of cellaring and caring for your wine. Collectors will pay more for wines that are well-cellared with a good ullage level, well-preserved label, and details of cellaring conditions.

For over 30 years, our Re-corking Clinics have helped guarantee the quality of aged Penfolds wines in circulation. With fewer bottles of poorly cellared Penfolds wine ever reaching the secondary market, auction buyers and collectors can confidently expect an extraordinary Penfolds wine experience. Bottles assessed and re-corked in our clinics and wines in pristine original condition nowadays achieve similar prices at auction.

The ultimate luxury aftercare service, Penfolds Re-Corking Clinics, take place every two years in various cities around the world. For collectors, our clinics are the best forum for tasting their wines with a Penfolds winemaker, sharing special moments and stories relating to their wine as they are assessed.